Four simple steps to Avoid SIM Swap Scams and Protect Your Mobile Identity

In today’s digital world, your phone is more important than ever. It’s often the key to your online accounts, banking, and even your identity. That’s why SIM swap scams have become one of the most dangerous forms of cybercrime. In this article we explain how to Avoid SIM Swap Scams and Protect Your Mobile Identity.

A SIM swap scam allows criminals to take control of your phone number, intercept security codes, and gain access to sensitive personal and financial information. The good news? You can take steps to protect yourself. In this article, we’ll explain how SIM swap scams work and share practical ways to keep your number safe.

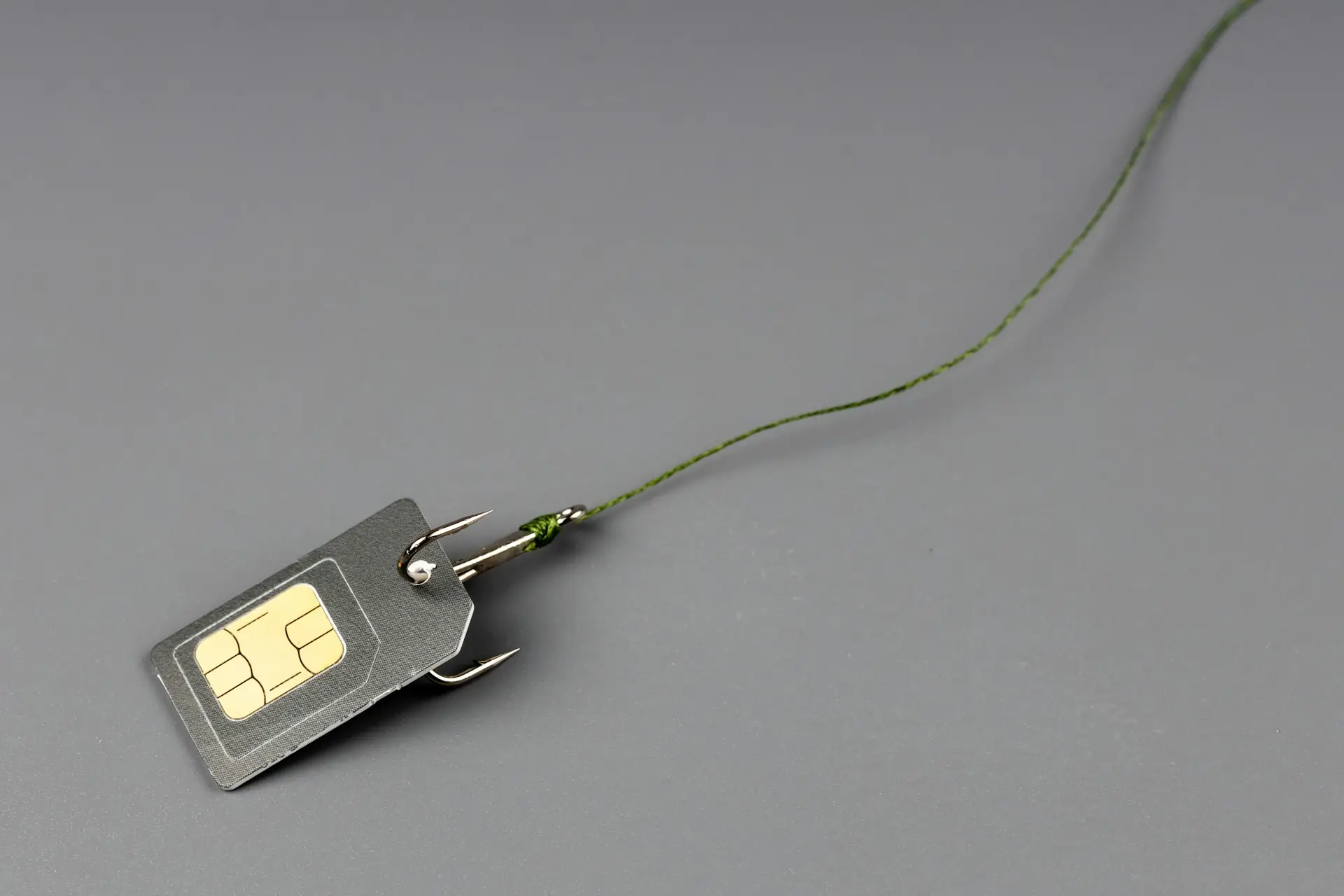

What Is a SIM Swap Scam?

A SIM swap scam (also called SIM hijacking or SIM jacking) happens when fraudsters trick your mobile carrier into transferring your phone number to a SIM card they control. Once they have control of your number, they can:

✔ Receive two-factor authentication (2FA) codes to access your email, banking, and social media accounts.

✔ Reset your passwords and lock you out of your own accounts.

✔ Impersonate you to scam your friends, family, or colleagues.

These scams often start with phishing attacks, data breaches, or social engineering—where criminals gather enough personal details (like your name, date of birth, or even your last phone bill) to convince your mobile carrier that they are you.

How to Know If You’re a Target

You might be a victim of a SIM swap scam if you experience:

✔ Loss of mobile signal – If your phone suddenly loses service (no calls, texts, or data) while others around you have a signal, it could mean your number has been transferred to another SIM.

✔ Unexpected notifications from your carrier – If you get messages about a SIM change or a new device activation that you didn’t request, that’s a red flag.

✔ Strange login alerts – If you receive password reset emails or security alerts from your bank or email provider about logins from new locations, act fast!

How to Protect Yourself from SIM Swap Scams

1. Strengthen Your Mobile Carrier Security

Most carriers offer extra layers of security to prevent SIM swaps. Here’s what you can do:

✔ Set a SIM PIN – Some carriers allow you to set a unique PIN that must be entered before making any SIM changes.

✔ Enable a Port Freeze – Some mobile networks offer a number lock or port freeze, which prevents your number from being transferred to another carrier without extra verification.

✔ Add a Customer Service PIN – Set up a strong, unique passcode with your carrier that must be provided before making any account changes.

2. Secure Your Online Accounts

Many SIM swap scams start with hacked email or social media accounts. Protect yourself with these steps:

✔ Use Strong, Unique Passwords – Avoid using the same password across multiple accounts. A password manager can help generate and store strong passwords.

✔ Turn On Multi-Factor Authentication (MFA) – Use app-based authentication (such as Google Authenticator or Authy) instead of SMS-based 2FA for better security.

✔ Limit Personal Information Online – Scammers often gather information from social media to impersonate you. Avoid sharing details like your birthday, phone number, or pet’s name (which are often used in security questions).

“Use app-based authentication (such as Google Authenticator or Authy) instead of SMS-based 2FA for better security.”

3. Stay Alert for Phishing Scams

Fraudsters often use phishing emails, fake texts, or phone calls to trick you into revealing personal information.

✔ Never Share Security Codes – Your bank or carrier will never ask for a one-time password (OTP) over the phone.

✔ Verify Caller Identity – If someone calls claiming to be from your bank or carrier, hang up and call back using the official customer service number.

✔ Watch for Fake Links – Avoid clicking links in unexpected emails or texts. Always visit official websites by typing the URL into your browser.

4. Monitor Your Accounts Regularly

The sooner you catch a SIM swap attempt, the better your chances of stopping it.

✔ Check Your Mobile Account – Log in regularly to ensure no changes have been made to your phone number or SIM card.

✔ Enable Banking Alerts – Set up SMS or email alerts for suspicious transactions in your bank accounts.

✔ Use a Backup Email – Have a secondary email address linked to your critical accounts in case your main one is compromised.

Final Thoughts

SIM swap scams are dangerous but preventable. By taking the right security measures—like locking your SIM, enabling strong authentication, and staying alert for scams—you can keep your mobile identity safe.

Stay vigilant, educate others, and always think twice before sharing personal information. Cybercriminals rely on deception, but with the right knowledge, you can outsmart them!

🚀 Stay safe and stay secure! 🚀

Leave A Comment

Related Posts

We’re thrilled to announce the launch of Saint Telecom, the latest venture by Saint IT Ltd, designed to revolutionize the way you connect with the world.

Are you ready for what has been dubbed the Great British Landline Switch Off? The good old days of BT landlines phones is coming to an end.

In the digital era, businesses are constantly seeking ways to streamline operations, improve efficiency, and reduce costs.